10 Typical Blunders That Cause A Tax Return Audit

Error No 10: Missing The Filing Deadline Or Not Declaring In All

What Is The Statute Of Restrictions For Irs Audits?

- If you claim transportation expenses, you'll need to record the gas mileage used for job.So, what causes a sales tax audit and exactly how do you decrease the danger of being investigated?Check and check the social security number on the return since that number represents the taxpayer's identity to the internal revenue service.With a sole proprietorship or an LLC, your organization earnings will travel through to your personal revenue and you will certainly report all of it on your individual tax return.As an example, you might have extra documentation if you have dependents, student finances and even more.

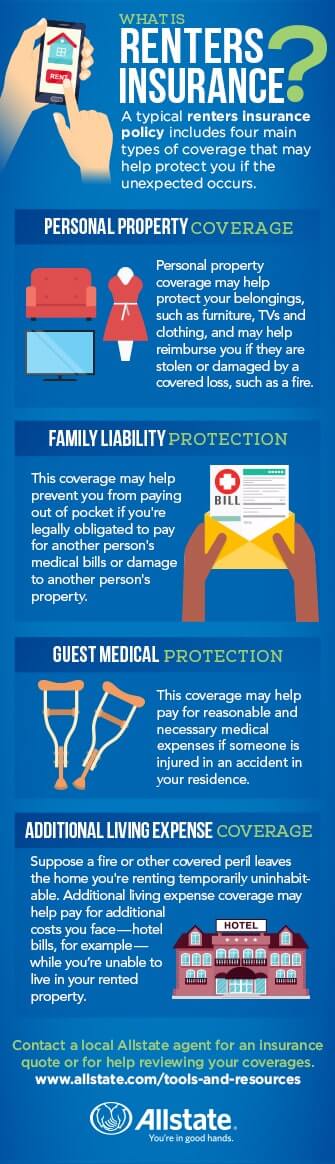

If you have inquiries concerning a short article or just intend to connect to our personnel, email A lost decimal point, an extra or absent zero and even a basic enhancement or reduction error can postpone your reimbursement or result in a smaller reimbursement than you were expecting. The ability to Renters insurance premiums create audit information rapidly saves time and can both strengthen your audit protection and protect your business's profits.

One more aspect that may help restrict professional exposure Tax forms is whether the taxpayer contributed to the issue or thought the risk of responsibility. Mean the tax professional asked the taxpayer to review the ready tax return for its accuracy, and the taxpayer either did not do so or did so negligently or carelessly. In such cases, despite the accountant's mistake or omission, the taxpayer had the last clear opportunity to fix the trouble. Depending on the territory, such situations may absolve the tax obligation specialist from obligation or lower the quantity of obligation to that percent for which each event might be deemed liable.We comprehend exactly how stressful it can be to run our business, so enabling a specialist to handle your tax obligations and accountancy is simply one less thing you have to stress over as a company owner. Although there is no other way to 100% evidence your return to avoid an audit, Go here for some suggestions to reduce your possibilities of being examined by the IRS. HMRC tax obligation investigations usually start when individuals or businesses submit tax returns late, pay tax obligations after the deadline, or make errors in income tax return that need correction. To avoid encountering a tax obligation investigation, it's important to comply with filing tax returns within the specified time limits, usually 1 month. With a single proprietorship or an LLC, your business earnings will pass through to your individual income and you will report all of it on your individual income tax return.

Declaring tax obligations can be a migraine, however do not allow it develop into a headache! Here's a quick guide to the top 10 mistakes that activate an Income tax return Audit. Numerous sorts of donations, cash money and various other, could be important tax reductions but taxpayers might not declare them. Alternatively, philanthropic donations are overestimated; non-cash donations can only be asserted at reasonable market price and must be in excellent or better condition. If you have already filed and paid your tax obligations, you are to be praised.

Accounting is about greater than simply following government guidelines when tax obligation period rolls around. A solid bookkeeping system offers you with crucial info that ... Companies typically come under the catch of poor documents for business expenses. Without appropriate invoices and documents, it comes to be difficult to confirm deductions in instance of an audit. The internal revenue service instantly checks to see that your reported earnings pairs up to what your employer submitted. It also obtains alerted of interest or profits from interest-bearing accounts, financial investments and stock trades, in addition to big gaming wins, inheritances and practically any other sort of income.

Relevant penalties may be included in problems emerging from shortages. However, courts have actually split on whether passion on an underpayment might be recouped, with some allowing healing by taxpayers. Preparers have occasionally been held accountable for taxpayers' incidental costs and even, in outright circumstances, for punitive damages. Specialist responsibility for certified public accountant tax obligation preparers and other tax obligation specialists can develop from errors or noninclusions in preparing customers' income tax return.

Organize your settlements timely by making quarterly approximated repayments in advance to make certain early refunds as well. Estimated quarterly tax obligation payments are due in April, June, September and January. A delay in filing and paying your tax obligations can be one of the most expensive error of all. A blunder in the estimation of internal revenue service payroll deductions may create chaos in your business. Be sure to obtain accurate and precise information concerning your staff members and the taxes owed in order to submit your pay-roll taxes appropriately.